TEAM is forming a consolidation pattern just below resistance, suggesting a potential breakout. The stock is trading within a narrow range, which may indicate accumulation before a possible upward move. A recommended strategy includes taking partial profits at predefined targets, adjusting the stop loss incrementally to lock in gains as the stock moves in the desired direction. Monitoring volume for a surge is crucial, as increased volume on a breakout would confirm the strength of the move.

EYPT recently surged and is now consolidating in a bullish flag pattern near 11.59. This formation suggests potential for further upward momentum if a breakout occurs above the flag’s resistance. The increase in trading volume during the initial upward move signals strong buying interest. Monitoring volume and price action around the 12.27 resistance level will be key to confirming a breakout and continuation of the trend.

FAST is approaching a key breakout point, as shown in the chart with strong upward momentum. A breakout above the current resistance level could signal a continuation of the upward trend. The recommended strategy includes taking partial profits at multiple targets while moving the stop loss progressively to protect gains. Initially, the stop loss is set to limit potential downside. It’s essential to monitor volume closely for confirmation of a breakout, as increased volume would signify a stronger move.

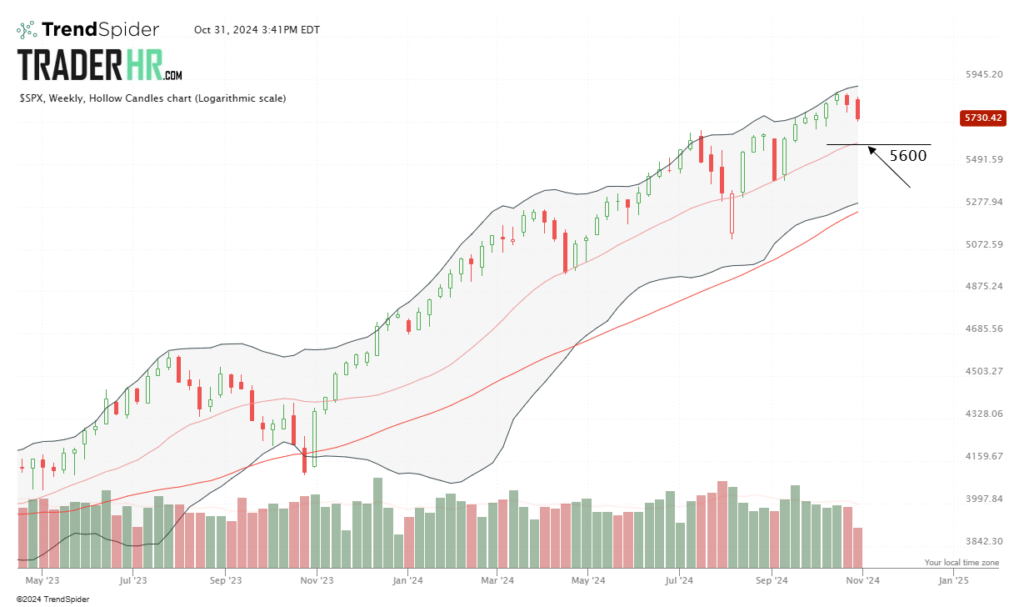

SPX is showing signs of a possible short-term pullback, with a retest of the 20-week SMA likely on the horizon. Staying cautious as we watch if this support level holds!

Unlock the Premium Trade Alerts for Today in the Members Area.

Anthony La Fazia

New York

"An amazing service. TraderHR is on his game but most importantly will always take the time to answer your questions and teach you the markets."

Annette J.

Montreal

"I have been with TraderHR for a few months and have had great success. He is not only a great analyst but a great teacher whom I have grown to respect as a trader and a person"

Marcos Oliveira

UK

“TraderHR is a proper professional analyst. Clear analysis and trading rules. Always seeking better ways to find better trades.”

Philip Haake

Colorado

I’ve been a member of many sites over the years, and I do the best right here. The daily watch list provides a steady flow of excellent charts to watch. It doesn’t take much work to pick the winners. Thank you very much !